Insufficient fun: The impact of financial stress on employee wellbeing

Tyler Munro

Tyler Munro

Tyler Munro is the director of brand and content at ZayZoon. He has previously led content marketing teams at OneTrust, Flybits and integrate.ai. In his spare time, Tyler writes literary fiction. His work has appeared in Yemassee Review and decomP, among others. He's also been nominated for the Pushcart Prize.

If you've ever lived paycheck to paycheck, then you know.

You know how stressful life can get.

All it takes is for one thing to go wrong.

A bad alternator.

Emergency dental work.

A sick kid who needs to go to the hospital.

And suddenly you're in survival mode. You need money fast. Money you don't have. Stress has hijacked your limbic system and your brain is drowning in cortisol. You're drowning. Because that's exactly what it feels like.

That's the experience almost 60% of Americans are grappling with today.

That's the experience many of your workers are grappling with right now.

And guess what?

It's damaging employee wellbeing.

And having a negative impact on your workplace.

Financial stress is no joke.

Which is exactly why you're reading this article. You want to make a difference.

Today, we're going to help you do just that.

What is employee wellbeing?

Simply put, employee wellbeing is the state of your employees' mental, physical, social, career and financial health. It's a holistic concept. In other words, you can't double-down on just a couple of these components of employee wellbeing and expect your team to be happy and fulfilled. You need to make a committed investment to all of them.

Refusing to do so could cost you. Because when employee wellbeing suffers, so does your business. Beyond making your workforce more productive, supporting good wellbeing is just the right thing to do.

Okay. Now that we've looked at what employee wellbeing is all about, let's quickly unpack each of its components.

1) Mental

When it comes to employee mental health, there are two threats you need to stay on top of:

- General, garden-variety workplace stress

- Burnout

By creating a company culture that has good work-life balance, you can effectively tackle both, but it takes a commitment from higher-ups. It’s one thing to say you have a good work-life balance and another to actually practice what you preach.

Beyond enforcing good work-life balance, there are plenty of other options to help you support employee mental health, including:

-

Comprehensive health insurance plans that include therapy or counseling

-

An Employee Assistance Program

-

Mental health days

-

Access to apps like Calm or Headspace

Another effective way to help employees with their mental health is to improve their physical health, which we’ll get into below.

2) Physical

Physical health is a critical part of employee wellbeing. Unfortunately, it’s something that too often suffers in today’s workplaces. But it doesn’t have to. Employers have plenty of options to help them boost employee wellbeing.

-

Employee wellbeing initiatives, including employer-sponsored yoga classes, sleep hygiene training, nutritional education, standing or walking meetings, etc.

-

Equipment that promotes better health, like stand-up desks, ergonomic chairs, etc.

-

A company culture that prioritizes physical wellbeing, with bike storage facilities, workplace fitness challenges and charities, etc.

-

A physical health stipend, etc.

When employees are in tip-top shape, so is your business. Anything you can do to improve their physical wellbeing make a huge difference.

3) Social

Social wellbeing initiatives don't need to break the bank.

If you're wondering how to build a more positive working environment and promote social wellness, consider:

-

regular check-ins, where managers can get a pulse on employee stress, mental health, and ultimately improve employee experience

-

social events and clubs, which have the added benefit of increasing employee engagement, as well as resulting in higher employee morale

-

employee recognition, whether through Slack, stand-ups or other public channels: anything you can do to make employees feel valued and promote positive well being goes a long way

4) Career

We spend so much of our lives working, which is why we want our jobs to be fulfilling. We want to know that, in some way, we are making a difference. But we also want to feel like we're growing and are being fairly compensated for that growth.

Careers should never be stagnant. They should be dynamic, challenging, rewarding... and if they are, we've got the career component of employee wellbeing covered.

Here are some tangible ways you can support career growth internally:

-

cultivating supportive relationships, especially between managers and reports

-

well-defined job roles and responsibilities, so that employees understand how they fit into the larger organization and what falls under their purview

-

initiatives to reduce work-related stress, like mental health days, recreational programs, open communications, etc.

-

working environments should include career pathing so that employees understand how to grow their careers

5) Financial

Here, let's defer to the Consumer Financial Protection Bureau's definition of financial wellbeing:

The ultimate goal of our work is to help you improve your financial wellbeing. Financial wellbeing means how much your financial situation and money choices provide you with security and freedom of choice.

Financial wellbeing is made up of four elements.

.jpg?width=1920&height=1080&name=Timeline%20Infographic%20Presentation%20Template%20(20).jpg)

In other words, it concerns the individual's ability to enjoy financial security and freedom of choice—in the present and future.

Today, we're going to get into the nitty-gritty of how financial stress impacts employee wellbeing. It should come as no surprise to learn that financial health can make or break an employee's experience of your workplace. We're going to unpack exactly how that happens and show you how to help, all without breaking the bank.

So, before we dig into it, let's fill you in on...

Where we got our data on employee financial stress

At the beginning of the year, we began surveying customers to learn more about their financial health. In total, we surveyed 5,000+ workers across a variety of industries, including: administration and support, healthcare, hospitality and food services (mainly quick-service restaurants), and many others.

We asked a total of forty-three questions across seven major categories:

-

Relationship with finances

-

Cash flow

-

Net worth

-

Opportunities for increasing income

-

Financial goals

-

Financial habits

This is all to say that everything you read here is informed by the latest data. It should provide you with a deeper understanding of your own employees, how their relationship with money impacts their performance at work, and what you, as an employer, can do to help.

Financial stress and employee wellbeing: the report highlights

Okay, now for the good stuff.

Without further ado...

Relationship with finances

Turns out, financial stress is top of mind for many of the workers we surveyed, with 56.8% experiencing it on a daily basis, if not more. Odds are, they’re coping with it during working hours and it’s impacting their day-to-day performance in the workplace.

According to Forbes, financial stress costs American businesses $40 billion per year. It’s not just something your employees take home with them once they clock out. They bring it to work with them every day as well, and it affects your business’ bottom line.

Cash flow

The majority of Americans live paycheck to paycheck, making it difficult if not impossible to maintain cash flow.

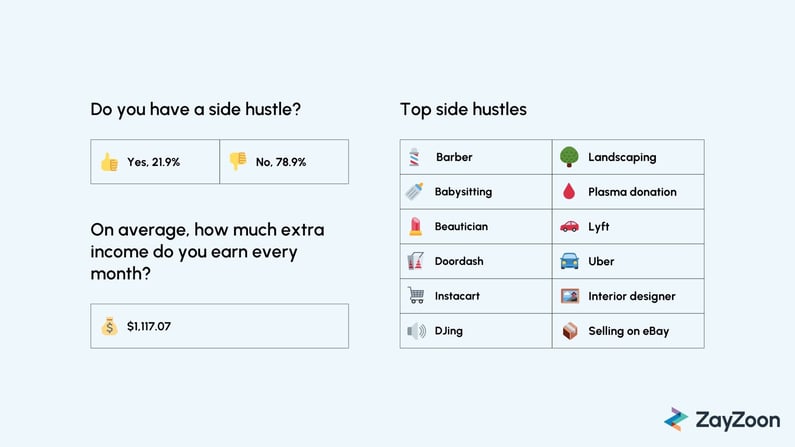

In our survey, we learned that nearly a quarter of respondents work a side hustle. It's easy to see why. These individuals were able to boost their overall income by 33!

One thing we did not uncover, was whether or not side hustles interfered with workers' day jobs. Either way, employers would be wise to explore solutions that can help employees unlock funds when they need them, whether that be loan programs, advances, etc.

Net worth

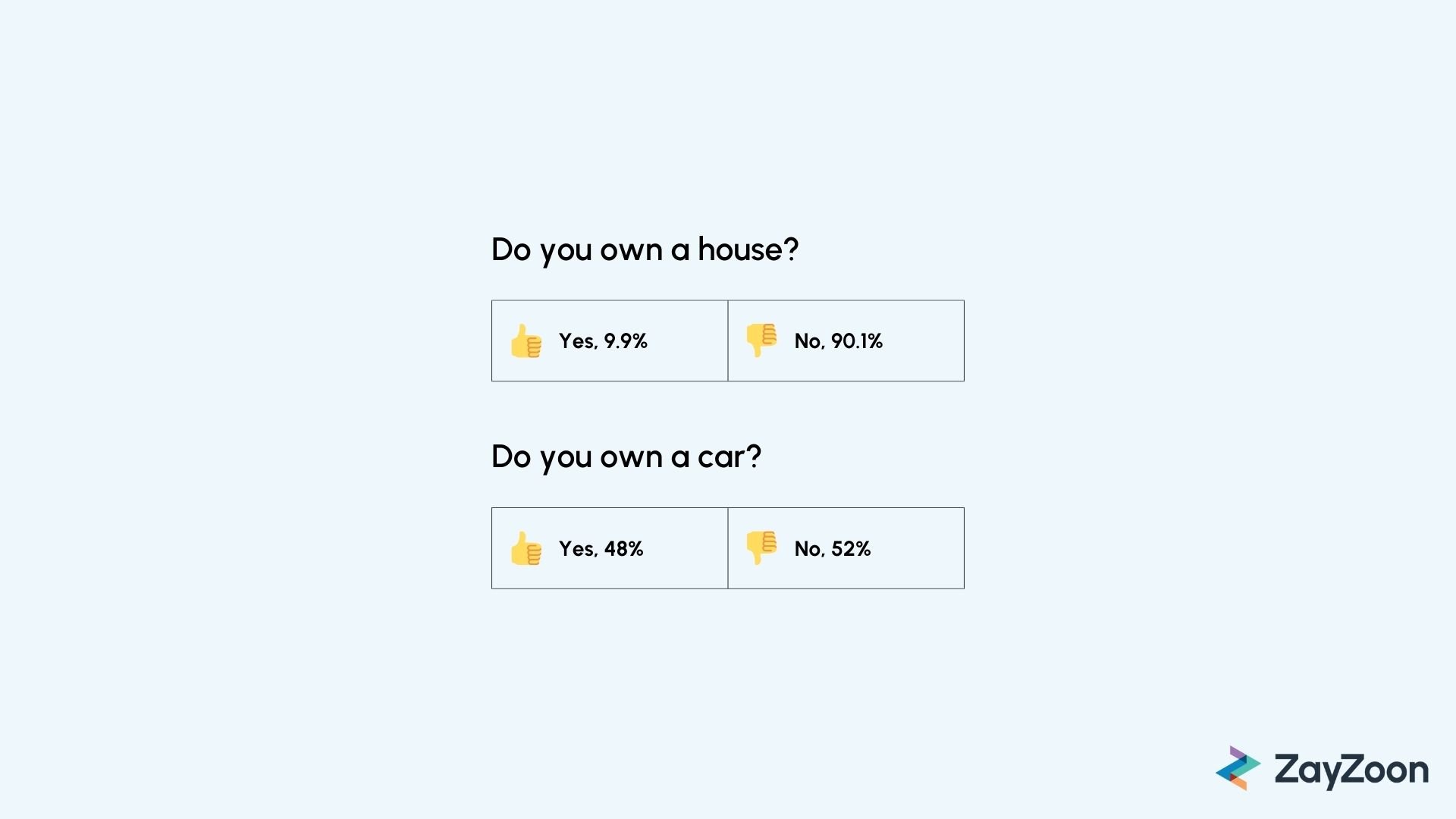

Employees did have a lower net worth than the national median ($19,257.16 versus $121,700).

That said, respondents belonged to a younger cohort (35% were 25 - 34). While car and home ownership were low, so was debt.

Opportunities for increasing income

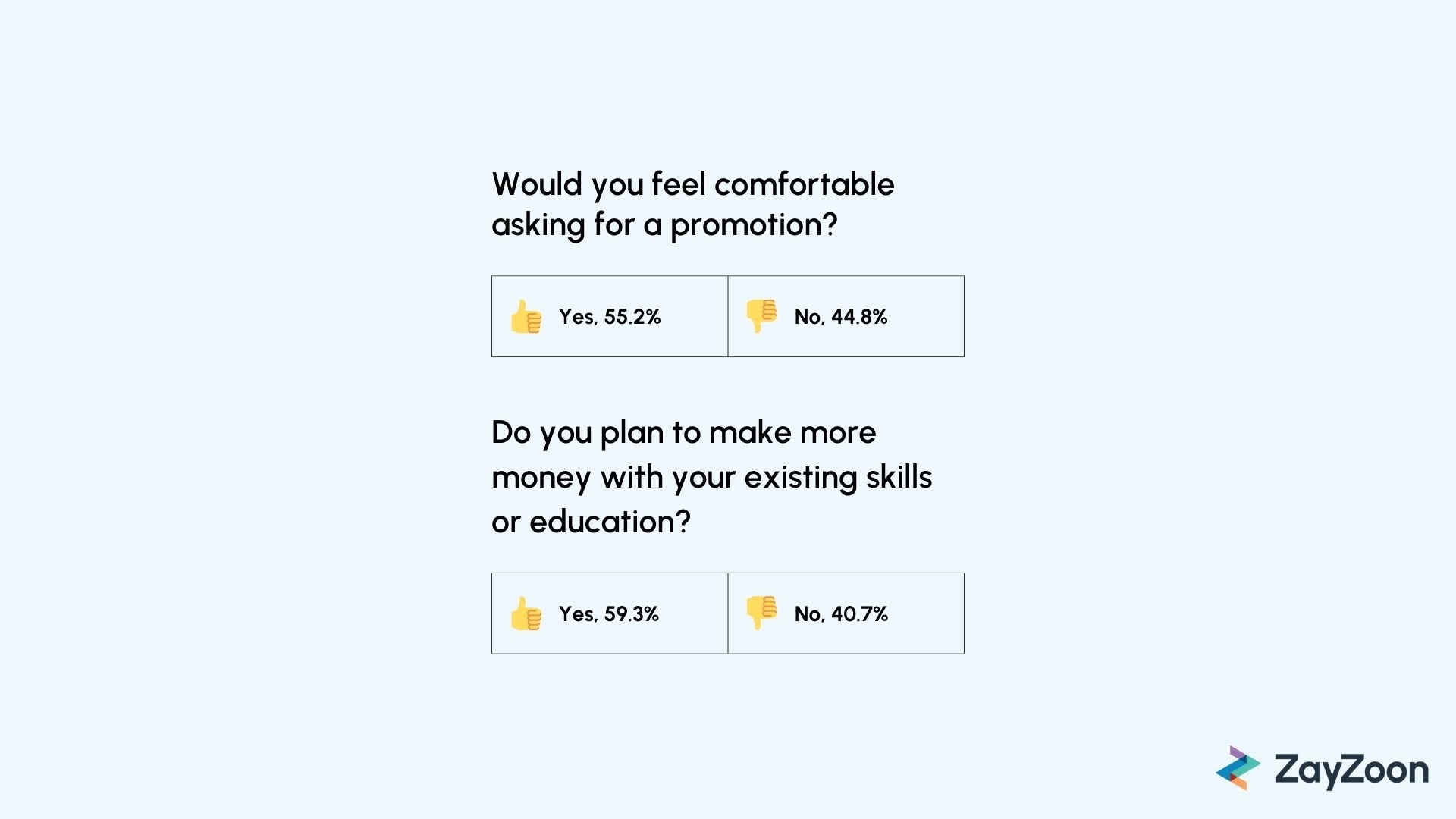

Overall, employees feel comfortable asking for a promotion. They are also keen to stick around and grow in their current roles, even if compensation isn't where they'd like it to be.

This is good news for employers.

In many cases, by simply showing employees what their future with your organization could look like, you are providing them with the reassurance they need to stick around.

Financial goals

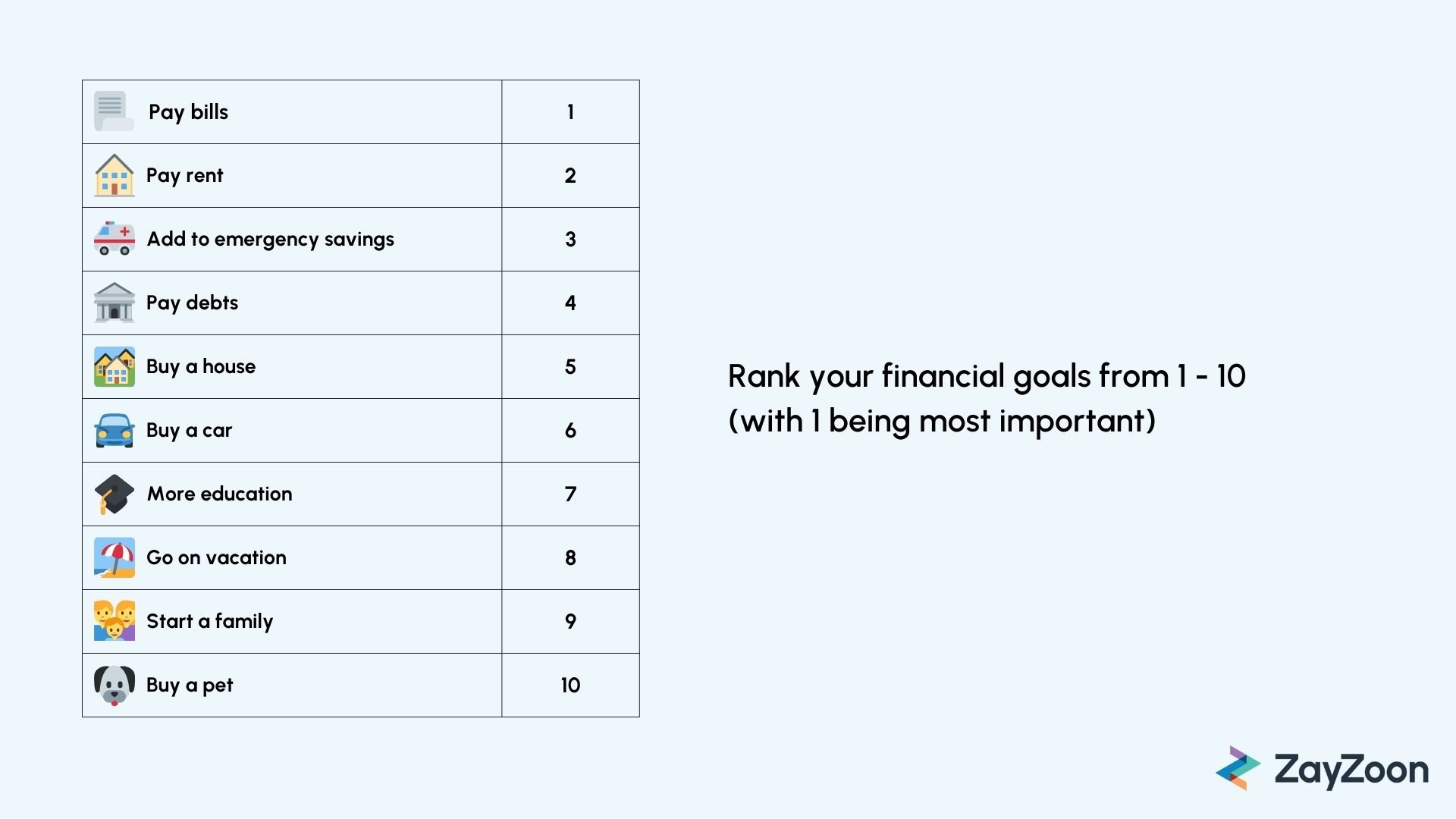

Unsurprisingly, paying off bills topped our respondents’ list of financial goals. After all, bills are the number one financial stressor according to 61.7% of respondents.

Most financial goals (paying off bills, making rent, building emergency savings and paying off debt) were reactive. This speaks to some of the challenges respondents face, like cash flow shortfalls, that prevent them from planning ahead.

Financial habits

In many cases, individuals rely on credit when they have a cash flow shortfall.

But what if you don't actually have access to credit?

Well, you'd have to borrow money, but without a credit score (or a bad credit score), you'd have to turn to a disreputable lender.

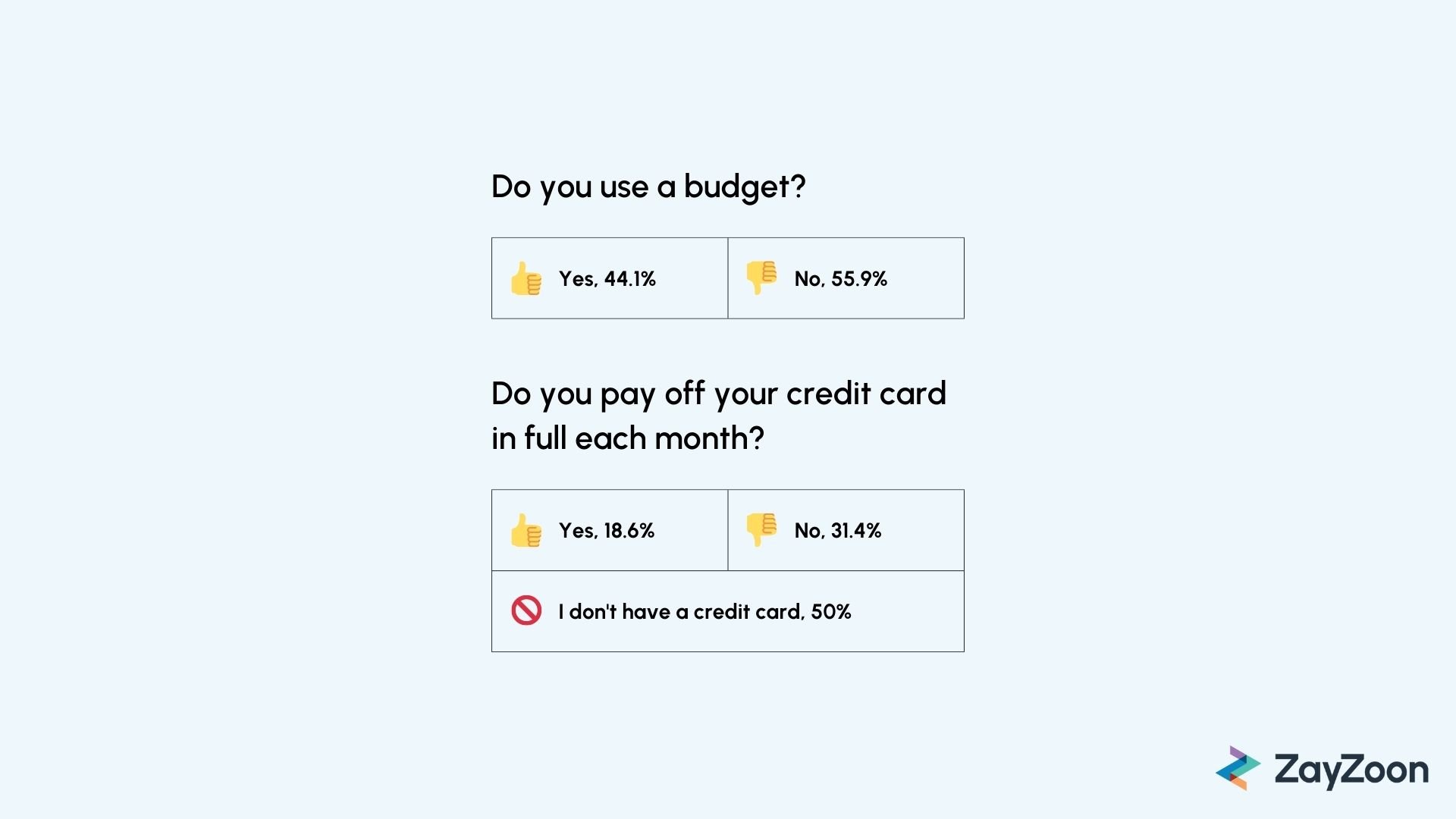

Half of respondents do not have access to a credit card. As I'm sure you can imagine, that can make life tough when they need cash in a pinch.

Again, it's easy to see how cash flow issues can trigger a chain reaction that leads to immense amounts of financial stress.

And it doesn't help that just over half of workers don't use a budget. There's an opportunity for employers to step in with financial wellness and support better spending and saving habits in their workforce.

Economic health of employees: what can you do?

Now that you’ve made it this far, you should have a deeper understanding of the financial stress your workers are under. As it turns out, financial stress impacts your business as much as it does your employees.

Hopefully, some of the tips offered in this report can help you address the financial stress in the workplace. At the very least, many of them enable you to embed an employee-first approach into your business without breaking the bank.

As far as takeaways go, here are three things you can do right now to help your employees and set your business apart.

- Identify the biggest financial stressors your employees are dealing with. Struggling to pay for meds? Gas prices too high? Cash flow issues? Use this report to guide and inform you.

- Take a deep dive into the financial wellness benefits landscape and see if there are any solutions that might work for you.

- If EWA is on your wishlist, definitely read our buyer’s guide. We provide you with guidance on what to look for, questions to ask vendors, and an in-depth comparison of the space’s top vendors.

Finally, if you simply want to talk to a real human being and learn more about Earned Wage Access, feel free to get in touch. We’re always happy to talk